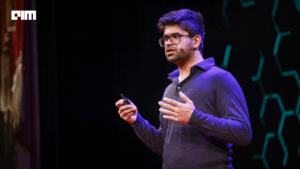

When Aidan Gomez talks about Cohere’s approach to artificial intelligence, he tends to focus less on model size or benchmarks and more on trust. “Privacy and security you cannot compromise on, you can’t go halfway,” he told the Financial Times last week.

Cohere was founded in 2019 by a group of former Google researchers including Gomez, Ivan Zhang and Nick Frosst. The company has just raised $500 million at a $6.8 billion valuation, according to its announcement. It does not build public chat apps. Instead it provides models and tools that companies can run on their own infrastructure. For organizations that handle regulated data, that difference matters.

The idea is simple. Banks, hospitals and governments are not comfortable sending their most sensitive data to a third party. They need control, audit logs and the ability to meet regulatory obligations. Cohere’s platform North is designed to provide those controls while still delivering automation and advanced language understanding. The company emphasizes on premises and hybrid deployments, and it says its stack can meet standards such as GDPR and SOC 2 while running on modest hardware when required.

The wider context has changed. Political tensions and national security concerns have made countries and large enterprises wary of handing the keys to a handful of cloud providers. Cohere’s Canada base and cloud agnostic stance allow it to offer a different promise, namely that modern generative AI can be used without relocating data or ceding control. Gomez has said sovereignty was a theme before recent geopolitics, but that the moment has sharpened.

There are practical advantages as well. Cohere has reported that its annual recurring revenue more than doubled in 2025 to over $100 million and is targeting $200 million by year end, according to reporting in the Financial Times and Bloomberg. For a company selling into regulated sectors, recurring enterprise contracts are a sign of traction that matters more than headline user numbers. The economics are different from consumer models that rely on massive scale.

The company’s recent hires underscore the change in priorities. Joelle Pineau, who until earlier this year led Meta’s Fundamental AI Research group, joined as chief AI officer. Francois Chadwick, who served as acting CFO at Uber, joined as chief financial officer. Those appointments mark a move from a research oriented startup to an organization expected to deliver operational reliability and compliance at scale.

That transition is not without risk. The moat of sovereignty can erode if hyperscalers and established enterprise software vendors adapt. Google, Microsoft and Salesforce already offer private deployment options and enterprise controls. Cohere will need to remain ahead on integrations, auditing and the operational experience of running agentic systems in production. Its advantage will depend on execution as much as concept.

There is a larger point for buyers and builders. Not every successful technology needs to be a consumer sensation. In many industries the most valuable software is the one that does its job quietly and reliably, and that gives predictable results under regulation and audit. For a bank or a hospital, invisibility is often a feature. A model that lives behind a company firewall and performs a defined set of tasks well can deliver measurable efficiency without the risk that comes with public exposure.

Cohere’s investor list and partner footprint suggest a growth path that matches this thesis. The most recent round included Radical Ventures, Inovia Capital, Nvidia and Salesforce Ventures. Strategic relationships with Oracle, Dell and several banks point to a channel based approach to scaling rather than a viral consumer strategy.

The company faces a clear choice. It can continue to refine a narrow but deep value proposition, focusing on trust, compliance and interoperability, or it can chase broader adoption and risk losing the precise controls that make it attractive to regulated customers. Either path requires trade offs.

Cohere’s origins matter here. One of the founders co authored the 2017 paper that introduced the transformer architecture, which underpins modern language models. That pedigree gives the company credibility on the technical side. But the next phase of growth will depend more on governance, integration and customer operations. What is certain is that there is real demand from institutions that need both capability and control.