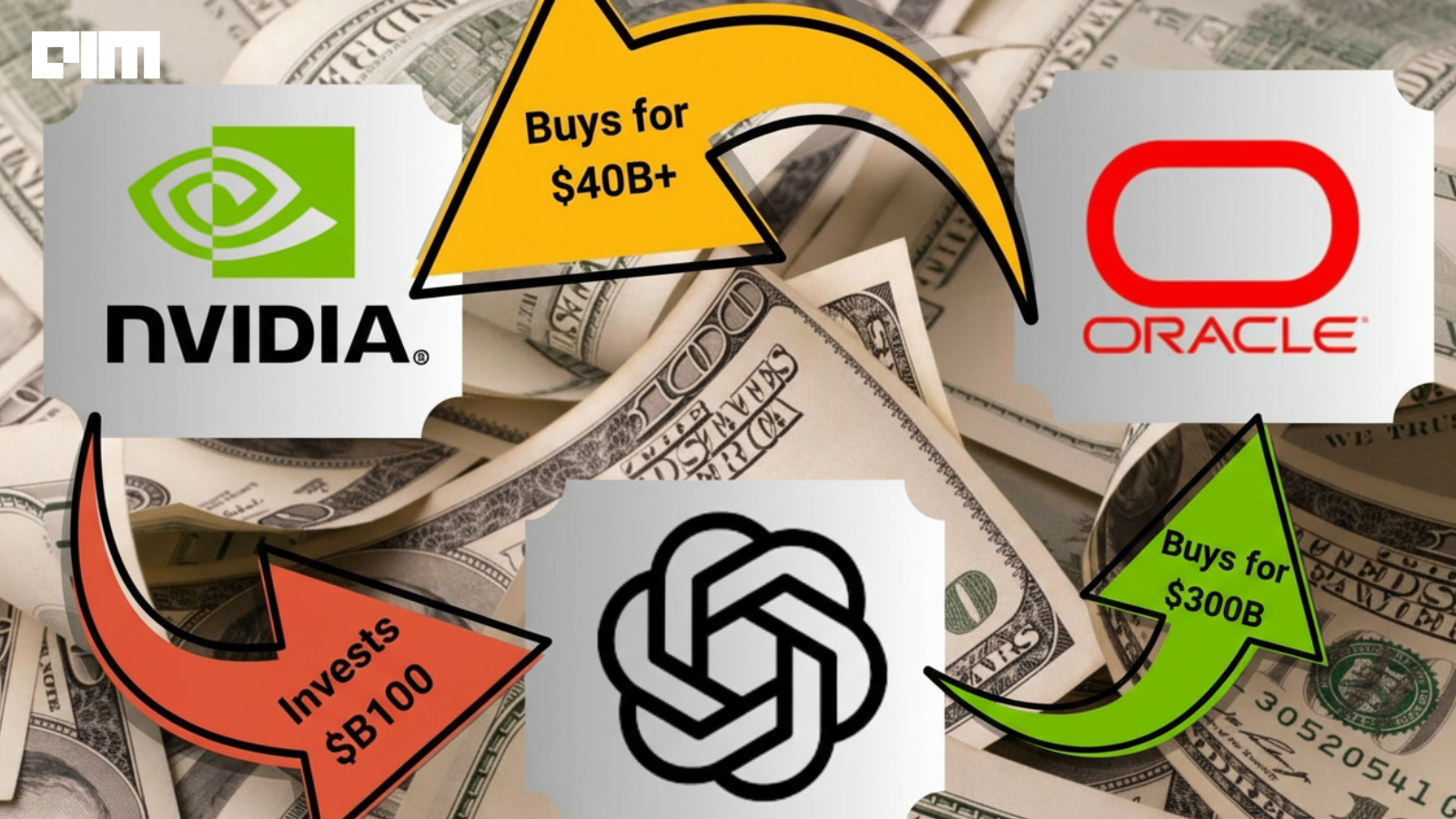

The latest tech bubble comes with a bundle of massive investments involving some of the biggest names. OpenAI committed $300 billion to Oracle for cloud computing services, Oracle invested $40 billion to buy NVIDIA’s cutting-edge chips, and NVIDIA pledged up to $100 billion back into OpenAI over several years.

These numbers might seem like a huge transfer of value to drive the growth of AI at first. But beneath the hype, an important question remains. What is the actual economic value here? And is this triad of investments more smoke than a straightforward capital infusion?

The ‘Capital’ Cycle

The way this investment cycle works is pretty complex. NVIDIA puts money into OpenAI to help them build the massive computing power needed for AI breakthroughs. OpenAI then uses that money to buy NVIDIA chips to fuel their data centers. Meanwhile, Oracle, who is responsible for building cloud infrastructure for OpenAI, spends a huge sum buying NVIDIA GPUs to power those data centers.

So the money just keeps bouncing around. NVIDIA invests, OpenAI pays NVIDIA, Oracle buys from NVIDIA, and the cycle continues. Each company plays a triple role: they are investors, suppliers, and customers all at once.

At first, this might look like a circle of innovation on a scale that’s never been seen before. The $300 billion Oracle contract over five years aims to build one of the biggest AI data center networks ever. NVIDIA’s $100 billion commitment to OpenAI shows its big bet on the future of AI hardware. And OpenAI, recently valued at $500 billion, highlights the market demand for AI-powered products.

Most of the investment is pre-allocated to infrastructure and operational expenses. NVIDIA’s $100 billion partnership with OpenAI, involves progressively disbursed investments tied directly to the deployment of new GPU-powered data centers. These funds largely recycle back to NVIDIA in the form of chip sales or leases. OpenAI spends capital raised not only on R&D but heavily on buying or renting NVIDIA’s specialized hardware.

Similarly, Oracle’s $300 billion cloud contract is a multi-year engagement for services, not a one-time cash infusion. In turn, Oracle invests tens of billions buying hardware from NVIDIA to upgrade its data centers. All these transactions form a cycle that supports the ecosystem but inflates what we see as “investment” volumes.

“This arrangement aids OpenAI in achieving ambitious objectives for compute infrastructure, while ensuring such resources are developed by NVIDIA. However, the ‘circular’ concerns previously raised may be amplified by this deal,” says Stacy Rasgon, Analyst at Bernstein.

A Sham or a Partnership?

The question people are asking is quite straightforward. Are these deals actually creating real economic value, or just spinning a fancy web of financial illusions to boost stock prices and impress investors?

It’s not simple to just call it a total sham or even a normal investment. What we’re seeing is a new kind of deep interdependence among tech giants, where each company’s success is tightly tied to the others’.

A similar example of intertwined investments is the partnership between Apple, Microsoft, and Intel during the late 1990s. In 1997, Microsoft invested $150 million in Apple at a time when the company was near bankruptcy. This deal included a five-year commitment to continue developing Microsoft Office for Mac, patent cross-licensing, and making Internet Explorer the default browser on Macs.

Meanwhile, Intel became Apple’s primary supplier of microprocessors, tailoring chip development to Apple’s hardware needs. Microsoft, Apple, and Intel operated as investors, suppliers, and customers within a tightly coupled ecosystem that created a complex cycle of financial flows and mutual reliance.

The OpenAI, Oracle, and Nvidia partnership is built to rapidly scale the huge computing power AI demands, while sharing the financial burden. There is still a very big risk involved here. When the same money keeps going around in circles, it can inflate stock prices and valuations beyond what’s actually justified. This could create a speculative bubble that could burst anytime.

After the announcements, Oracle’s stock shot up nearly 36%, giving founder Larry Ellison a brief rise to the top of the global wealth charts. NVIDIA’s shares climbed as well, boosting its market value by hundreds of billions of dollars. Investors clearly cheered this collaboration, seeing it as a sign of the next phase in AI.

But some analysts still warn that the financial details mask a more complicated story. One where revenue recognition and capital commitments intertwine, with much of the money simply cycling back within this system. Industry watchers debate how much of this capital truly fuels innovation versus how much supports financial optics and competitive positioning.

This capital influx shows us how AI infrastructure must be built collaboratively given the scale and cost of data center deployments. No company could bear the $500 billion in planned infrastructure spending alone. Instead, alliances and joint ventures become necessary. As these deals evolve, regulators should focus on transparency and ecosystem health to avoid excessive financial speculation.