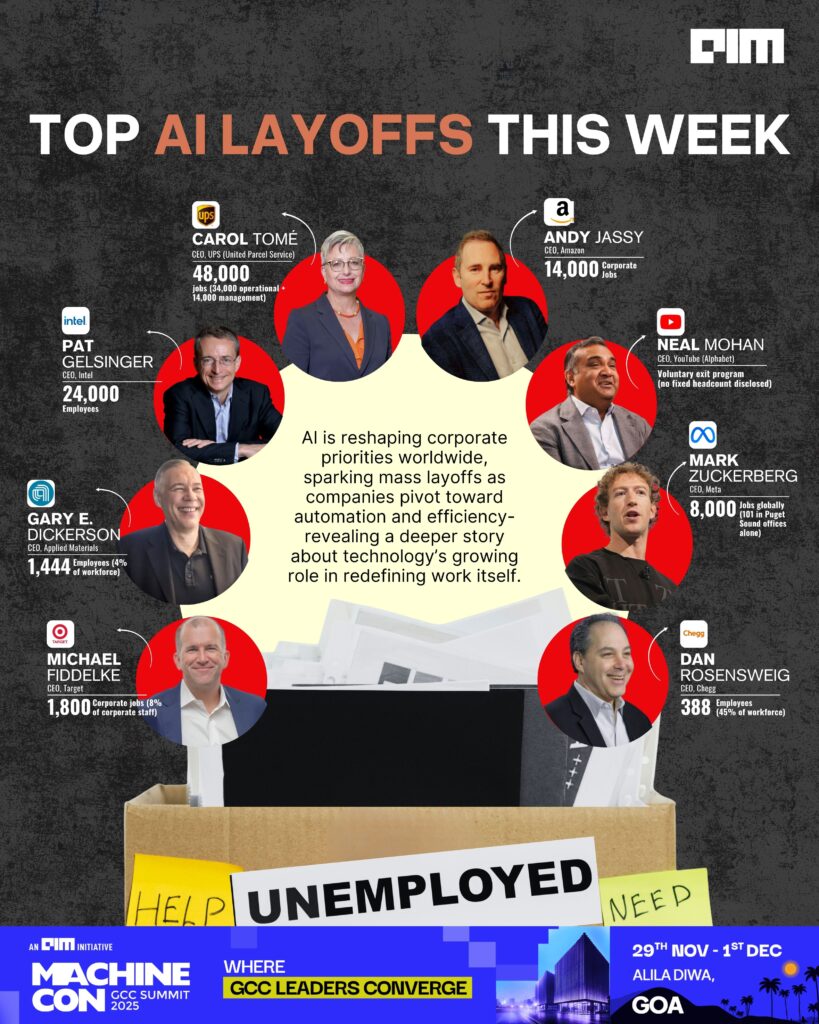

AI-driven corporate layoffs sweeping through major companies this week reveals a deeper story about downsizing. From Amazon and Meta to UPS and Intel, thousands of employees have been caught in what some call the inevitable rotation of a new era. But not everyone agrees on the cause.

Perplexity CEO Aravind Srinivas argued that the headlines blaming AI for mass layoffs miss the mark. “They overhired in the COVID era when they didn’t actually need to — the results of that are being seen now,” he said. “Correlation doesn’t imply causation. It’s not because of AI that people are losing jobs.” CoreWeave’s Michael Intrator, by contrast, sees the turbulence as part of a long-standing cycle in technology’s evolution: “During each technical revolution, there is a rotation that occurs, and one of the roles for government is going to be to assist in that rotation to retrain, to repurpose, to allow people to build careers.” And as CrowdStrike CEO George Kurtz put it, AI may not erase work but rather redefine it: “Essentially, working alongside AI and that’s what humans will do.”

Across industries, companies are restructuring to align with new AI priorities. From logistics to media to semiconductors, automation and machine learning are being embedded deeper into operations, often accompanied by significant workforce reductions. While executives frame these decisions as efforts to improve focus, agility, or technical readiness, the cumulative effect has been sweeping job cuts across the global corporate landscape.

Here’s a look at the top AI-driven corporate layoffs this week and how the world’s biggest companies are recalibrating for an era where humans and machines must learn to share the load.

Amazon

CEO: Andy Jassy

Layoffs: 14,000 corporate jobs

Amazon’s latest round of layoffs, eliminating around 14,000 corporate roles, or roughly 4% of its white-collar workforce which marks one of its most significant reorganizations since the pandemic hiring surge. While early reports suggested the cuts were tied to AI-driven efficiency goals, CEO Andy Jassy clarified during the October 2025 earnings call that the move was primarily cultural, not financial or technological. As Amazon expanded rapidly to a total headcount of 1.55 million, Jassy said the company had developed too many managerial layers, which “weakened ownership” and slowed decision-making. The layoffs, affecting teams across logistics, payments, gaming, and AWS cloud, and majorly the retail team are part of his push to restore Amazon’s hallmark agility by returning authority to frontline teams and streamlining its corporate hierarchy. Still, the cuts follow years of post-pandemic belt-tightening after 27,000 roles were shed in 2022–23 and align with Jassy’s broader effort to reposition Amazon for leaner, AI-enhanced operations.

YouTube (Alphabet)

CEO: Neal Mohan

Layoffs/Exits: Voluntary exit program (no fixed headcount disclosed)

YouTube’s restructuring this week marked one of its most significant shifts under CEO Neal Mohan, as the company reorganized around artificial intelligence to match its expanding scale and ambitions. Announced on October 30, 2025, the overhaul established three new product divisions—Viewer Products, Creator and Community Products, and Subscription Products, each reporting directly to Mohan. The move, effective November 5, is designed to modernize YouTube’s decade-old structure and align decision-making with areas of fastest growth, including generative AI for creators. Mohan described AI as “the next frontier for YouTube,” emphasizing that it will power everything from content discovery to creative tools. While no layoffs were mandated, eligible U.S. employees in the restructured product and engineering teams were offered voluntary exit packages as part of an efficiency and accountability push. The reorganization comes amid record financial performance for parent company Alphabet, which crossed $100 billion in quarterly revenue for the first time, driven in part by YouTube’s 15 percent surge in ad sales to $10.26 billion.

Meta

CEO: Mark Zuckerberg

Layoffs: 8,000 jobs globally (101 in Puget Sound offices alone)

Meta’s latest round of layoffs underscores its ongoing effort to streamline operations and consolidate power within its expanding AI empire. Roughly 600 employees were cut from its artificial intelligence division this week, marking another phase of CEO Mark Zuckerberg’s “strategic realignment” following the 2023 “Year of Efficiency.” The cuts, confirmed in a memo from Chief AI Officer Alexandr Wang, who joined in June as part of Meta’s $14.3 billion investment in Scale AI, affected teams across Meta’s AI infrastructure, FAIR (Fundamental Artificial Intelligence Research), and other product-related units. The restructuring aims to eliminate redundancy and refocus resources under Wang’s leadership, solidifying his control over Meta’s AI roadmap. Insiders said the layoffs largely spared newer hires in the recently formed Superintelligence Labs, signaling Zuckerberg’s preference for Wang’s team of high-profile recruits over legacy AI staff. Employees impacted by the cuts were placed on a non-working notice period until November 21, during which they were encouraged to seek internal transfers.

Chegg

CEO: Dan Rosensweig

Layoffs: 388 employees (45% of workforce)

Chegg’s collapse this year captures how generative AI can upend an entire business model overnight. The Santa Clara-based edtech firm announced it would cut 45 percent of its staff, roughly 388 employees, as part of a sweeping restructuring led by returning CEO Dan Rosensweig. The move follows a 22 percent reduction in May, bringing total layoffs to more than half of Chegg’s pre-AI workforce. The company cited “the new realities of AI and reduced traffic from Google” as key reasons for its decline, acknowledging that tools like ChatGPT have made its $15-a-month homework help model obsolete. Once reliant on students typing questions into Google, Chegg has watched its traffic, subscribers, and stock value plummet, down 90 percent since 2021. The October layoffs are expected to save up to $110 million in 2026 expenses but come at the cost of deep cuts to marketing and product operations. Rosensweig is now steering Chegg toward the $40 billion corporate skilling market, expanding through its Busuu acquisition in language and workplace training.

Target

CEO: Michael Fiddelke

Layoffs: 1,800 corporate jobs (8% of corporate staff)

Target’s latest round of layoffs, cutting about 1,000 corporate employees and eliminating another 800 open roles signals a major cultural and operational reset under incoming CEO Michael Fiddelke. Long celebrated for its collaborative culture, the Minneapolis-based retailer now faces internal unease after a chaotic layoff rollout that included technical glitches and abrupt termination emails. Fiddelke acknowledged that Target’s corporate structure had become “too layered and slow,” saying AI automation and leaner decision-making will be central to rebuilding efficiency. But the move comes at a turbulent time: the company is reeling from 11 consecutive quarters of weak comparable-store sales, boycotts following its DEI rollback, and a 7.6 percent drop in September foot traffic. Employees describe a growing sense of uncertainty and diminished trust in leadership.

Applied Materials

CEO: Gary E. Dickerson

Layoffs: 1,444 employees (4% of workforce)

Applied Materials, one of the world’s largest semiconductor equipment makers, is laying off about 4% of its workforce with roughly 1,400 employees in a sweeping restructuring designed to align with the next wave of AI-driven chip manufacturing. The Santa Clara–based company confirmed that 363 roles were eliminated across California, including 262 in Santa Clara, 86 in Sunnyvale, and several remote positions, spanning engineers, technicians, financial analysts, legal teams, and 14 vice presidents. CEO Gary Dickerson told employees that “automation, digitalization, and geographic shifts are redefining our workforce needs,” emphasizing that the layoffs are part of a long-term realignment rather than a financial retrenchment. Despite record quarterly revenue of $7.3 billion, Applied Materials said the restructuring will cost $160 million to $180 million in severance and related expenses.

Intel

CEO: Pat Gelsinger

Layoffs: 24,000 employees

Intel is undertaking one of the largest workforce reductions in its history, cutting between 20,000 and 30,000 jobs as part of a sweeping turnaround aimed at restoring its competitiveness in the semiconductor and AI chip markets. The restructuring, led by CEO Pat Gelsinger and new executive chairman Lip Bu Tan, follows years of manufacturing setbacks and intensifying competition from Nvidia and AMD. The layoffs, which began in California and Oregon and will extend globally, are expected to reduce Intel’s headcount from roughly 109,000 to around 75,000 employees. The cuts are tied to a multiyear transformation plan that redirects resources toward Intel’s foundry services and AI computing units while exiting slower-growth PC segments. Gelsinger described the restructuring as essential to making Intel “faster, leaner, and more cost-disciplined,” even as the company faces pressure to regain market share and credibility in the race to build next-generation AI chips.

UPS (United Parcel Service)

CEO: Carol Tomé

Layoffs: 48,000 jobs (34,000 operational + 14,000 management)

UPS is executing one of the most sweeping restructurings in its history, cutting nearly 48,000 jobs in 2025, far above initial projections of 20,000 as part of a deep AI- and automation-led transformation of its logistics network. CEO Carol Tomé framed the move as a necessary modernization effort amid falling parcel volumes, declining margins, and a 30 percent drop in share value this year. The company eliminated 34,000 operational roles and 14,000 management positions while shutting down about 90 facilities, linking the cuts to a $3.5 billion cost-savings target. Central to this overhaul is a massive automation expansion: AI-driven routing, robotics, and predictive analytics now manage roughly two-thirds of UPS’s package volume. Partnerships with robotics firms like Dexterity and reported talks with Figure AI underscore the company’s push toward intelligent warehousing. UPS has also introduced machine-learning tools such as Deal Manager, which automates pricing and sales processes as part of broader efforts to reduce white-collar layers while boosting efficiency.

Paramount (Paramount Global / Skydance)

CEO: David Ellison

Layoffs: 1,000 jobs (1st wave; 1,000 more expected)

Following its $8.4 billion merger with Skydance Media, Paramount Global underwent an aggressive restructuring under new CEO David Ellison, cutting roughly 1,000 jobs, about 5 percent of its pre-merger workforce, with more rounds expected in the following months. The layoffs, carried out between October 27 and 29, 2025, targeted overlapping roles across television, streaming, and corporate functions as Ellison moved to integrate Skydance’s technology-first model into Paramount’s legacy entertainment operations. In a company-wide memo, Ellison said the reorganization was intended to “strengthen focus on growth” and accelerate the use of AI in content production, digital distribution, and audience analytics. The cuts followed earlier cost-saving measures under previous leadership that had already trimmed $500 million in expenses and eliminated hundreds of roles in advertising, communications, and studio divisions. Paramount, which had 18,600 employees and about 3,500 project-based workers at the end of 2024, also introduced a phased return-to-office mandate beginning January 2026, offering severance packages to employees who chose not to return to in-person work.