Adobe has yet again made a major move. On Wednesday, the company announced its acquisition of Semrush, an SEO and brand visibility platform, for $1.9 billion. The deal definitely had a way bigger motive. Adobe wants to prove that marketing visibility doesn’t have to be solely focused on Google rankings anymore. They want to stop that monopoly with the goal of staying visible inside AI.

Nowadays, finding things online doesn’t have to be through a search bar. You can ask ChatGPT for restaurant recommendations. Use Perplexity to research a product. Ask Claude to help you plan a trip. You’re basically scrolling through answers generated by Gemini. For brands, this shift is huge. If your product doesn’t show up when someone asks an AI for help, you’re invisible.

In October alone, traffic to retail websites from gen AI chatbots jumped 1,200% compared to a year earlier. This trend shows how people have changed the way they interact with the web.

Adobe offered $12 per share for Semrush, nearly double its closing price the day before the deal was announced. Semrush had a market cap of about $1 billion before the announcement. Adobe is paying nearly double that. This shows that they clearly have a way broader plan in mind.

Adobe is basically acquiring market timing. It’s hoping that GEO, generative engine optimization, is about to become as critical to marketing as SEO has been for the past two decades. Semrush recently launched tools for something called “generative engine optimization” (GEO), which is basically SEO, but for AI. Instead of optimizing your website for Google’s algorithm, you’re optimizing for how ChatGPT, Claude, Copilot, Grok, and Perplexity feature your content in their responses.

It sounds niche, but for brands, it’s becoming essential in keeping up with competitors. As more people use AI to research and shop, being featured in an AI-generated answer is becoming as important as ranking on page one of Google. Your product recommendation shows up in a ChatGPT response? You get a customer. Your website gets ignored? You lose the sale to a competitor who actually optimized for AI visibility.

Semrush has been investing in GEO for months, building tools that let marketers track how their brands appear across multiple AI engines. That expertise is exactly what Adobe needed.

The Adobe Play

Adobe already owns the marketing stack most enterprises rely on. Adobe Experience Manager for content, Adobe Analytics for data, and the newly launched Adobe Brand Concierge for customer experience orchestration.

Now, adding Semrush’s GEO and SEO expertise creates something more comprehensive. A platform that helps brands understand and optimize their visibility everywhere including Google search, AI engines, social media, and owned channels.

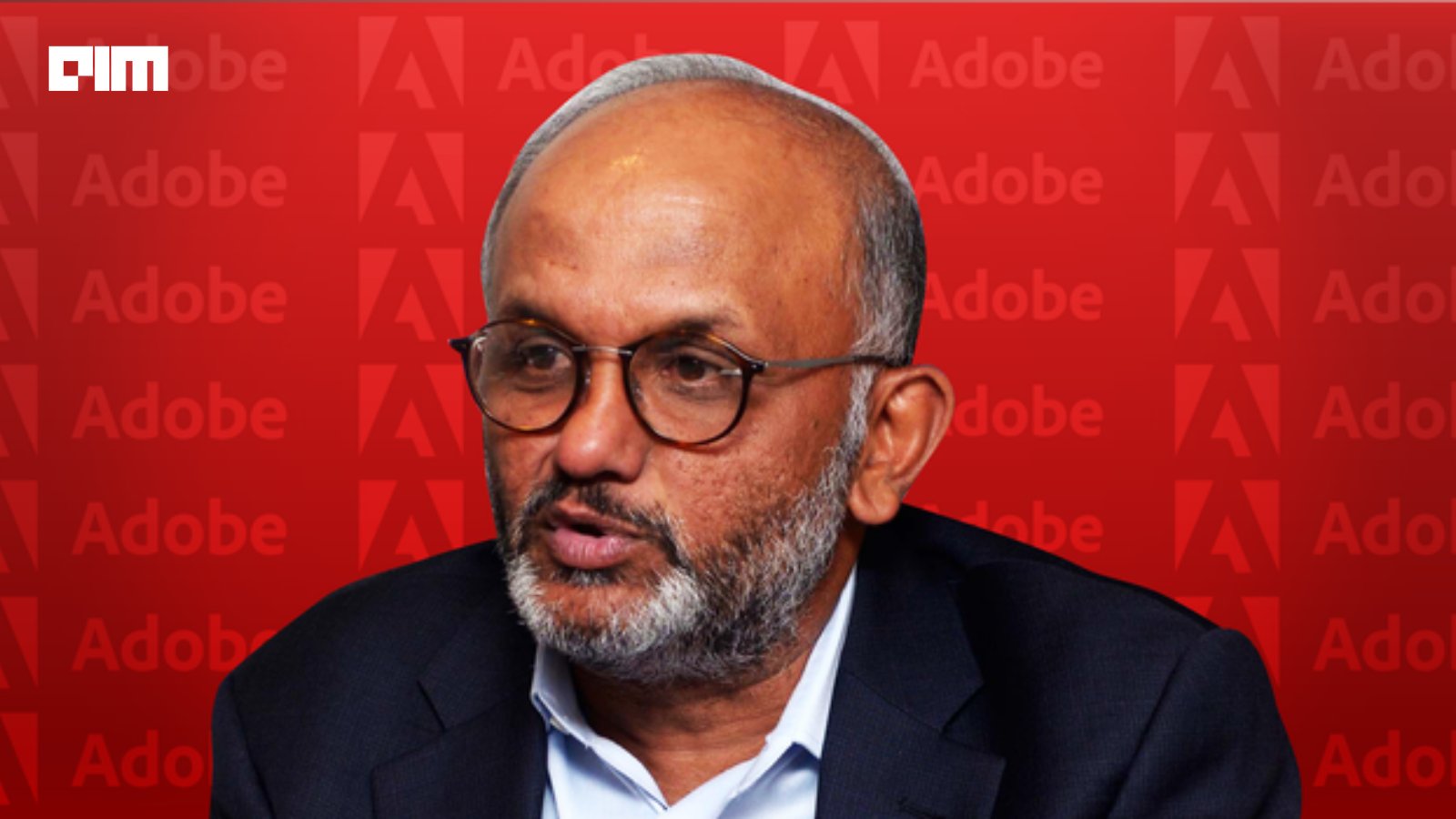

“Brand visibility is being reshaped by generative AI, and brands that don’t embrace this new opportunity risk losing relevance and revenue,” said Anil Chakravarthy, Adobe’s Digital Experience president.

Semrush isn’t a new startup that’s testing theories. The company has 10+ years of SEO credibility built on real results. In the most recent quarter, Semrush grew annual recurring revenue 33% year-over-year in its enterprise segment.

That’s considered to be a massive growth. Customers include Amazon, JPMorganChase, and TikTok which companies that understand the competitive stakes of brand visibility and have the budgets to invest in it.

Semrush has proven it can deliver enterprise-grade solutions that drive real business outcomes. Adobe is hoping that same expertise will translate into enterprise-grade GEO solutions.

Adobe’s stock has been under pressure in 2025, with investors demanding proof that the company can actually monetize AI beyond adding AI features to existing products. This acquisition is their answer.

Adobe is now buying the tools that let brands actually optimize themselves. The market agreed with Semrush stock jumping 74% after the announcement. If Adobe thinks GEO is worth $1.9 billion, then GEO must be real.

What Actually Changes?

For marketing teams, they’ll soon have the ability to track and optimize brand visibility across both traditional search and gen AI platforms from a single dashboard. That integration matters since marketers are already turning to their SEO teams to drive generative AI strategies. Adobe and Semrush together can make that job significantly easier and more effective.

Google and Meta are also investing heavily in AI-powered marketing tools, but both tend to optimize primarily for their own ecosystems. However, Semrush is genuinely model-agnostic.

It doesn’t favor ChatGPT over Claude, or Gemini over Perplexity. For brands using multiple AI platforms simultaneously, that neutrality matters a lot. Adobe and Semrush are building the neutral playbook that works across all of them.

For the past 15 years, Google’s search algorithm defined brand visibility. The next 15 years will be shaped by LLMs. Brands that figure out how to stay visible in both will dominate and those that don’t will eventually fade away.

Adobe has already secured commitments from Semrush’s founders and other major shareholders representing over 75% of voting power to approve the deal. The deal will most likely close in the first half of 2026.

“Adobe is an industry leader in helping marketers create personalized customer experiences at scale. With the advent of LLMs and AI-driven search, brands need to understand where and how their customers are engaging in these new channels. This combination provides marketers more insights and capabilities to increase their discoverability across today’s evolving digital landscape,” said Bill Wagner, CEO of Semrush.