Banks are appointing dedicated artificial intelligence leaders at a pace not seen before. JPMorgan Chase has rolled out generative AI to almost all its employees, Citi is introducing agentic AI to roughly 40,000 developers, and Truist Financial named its own chief AI officer this week. Wells Fargo has now taken a similar step, elevating Saul Van Beurden to lead AI adoption across the company while restructuring its consumer businesses around him.

The San Francisco–based lender named Van Beurden co-CEO of a newly combined consumer banking and lending division and said he will also be responsible for expanding the deployment of AI tools across business lines. Charles Scharf said the new structure is intended to align how consumers use the bank’s services and to ensure business heads integrate new technologies into their operating models. “Success will be driven by business heads embracing these new technologies and rethinking their own operating models using generative and agentic AI solutions,” he said.

Expanding AI Inside One of the Country’s Largest Banks

Wells Fargo has steadily increased its AI investments over the past several years. In 2021, the bank began a partnership with Google Cloud. In 2022, it launched Fargo, a virtual assistant built on Google’s conversational AI platform. This year, Wells Fargo trained more than 90,000 employees on new AI systems and deployed AI tools to more than 180,000 desktops.

In August, the bank began rolling out generative and agentic AI to all 215,000 of its employees. The tools include AI agents that help bankers, marketers, customer relations teams, and corporate employees search documents and extract real-time insights. “Our employees and customers have powerful models in their hands. They expect the same at work,” Van Beurden told Forbes.

CEO Charlie Scharf has repeatedly underscored the bank’s commitment to AI. “Generative and agentic AI will reshape competitive dynamics across every industry, and we are embracing these tools as we have embraced robotic process automation and machine learning for years,” he said.

Wells Fargo said the new co-CEO structure reflects how closely Van Beurden and Kleber Santos already collaborate. Santos, who previously served as CEO of consumer lending, will jointly run the merged consumer banking and lending business. Giving both leaders responsibility for the combined division, according to the bank, reflects how their teams already work and supports a more unified customer experience.

“Mr. Santos and Mr. Van Beurden have been working closely for some time to deliver a seamless experience for consumers,” Wells Fargo said. “Naming them co-CEOs and combining the businesses formally is a natural out-growth of how they work today.”

The arrangement also gives Van Beurden time to focus on the bank’s broader AI agenda, with Scharf expecting him to work directly with business heads to advance transformation programs. “Saul will partner with our business leaders to ensure they are leading their own transformation and will be accountable to me for consistent and meaningful progress across the company,” Scharf said.

Restructuring as Workforce Changes Advance

Wells Fargo’s leadership changes are unfolding during a period of continued workforce adjustment. Scharf said he expects the bank’s headcount to decline further as part of ongoing efforts to improve efficiency. Since he joined in 2019, total employees have decreased from approximately 275,000 to just over 210,000.

“It’s likely we’ll have less headcount as we look forward…we’d like to do as much of it through attrition as possible,” Scharf said in an interview. He described the bank as “way too inefficient” and “way too bureaucratic,” adding that many internal processes do not add value.

Scharf also noted that advances in AI will play a role in workforce changes. “The opportunities that exist in AI are very significant,” he said. “Anyone who sits here today and says that they don’t think they’ll have less headcount because of AI either doesn’t know what they’re talking about or is just not being totally honest about it.”

Wells Fargo is not alone. Analyst Brian Foran of Truist Securities said the rise of dedicated AI executives across the industry reflects the scale of the technology’s impact. “It’s a signal that from the top down, we really think this is important,” he said. Foran added that banking remains a “people-heavy business,” and AI adoption offers banks a way to increase capacity without expanding staff.

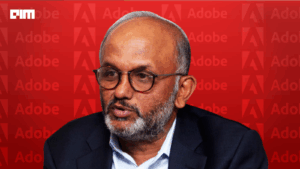

A Leader With Deep Technology Roots

Van Beurden’s appointment places one of Wells Fargo’s most experienced technology executives at the center of its AI rollout. He joined the bank in 2019 after serving as chief information officer of consumer and community banking at JPMorgan Chase. Before that, he held technology and operations roles at ING Group and Marsh McLennan.

From 2019 to 2023, he led technology at Wells Fargo before being elevated to CEO of consumer and small-business banking. His background has shaped his leadership approach. “Retail is scale,” he said. “You cannot run 4,000 branches manually. Everything must be automated.”

He credits his time at ING for reinforcing the need for simplicity in digital banking, and his experience at JPMorgan for exposing him to the risks that come with large-scale systems. “You are defined by how you prevent and manage the crisis, not by the happy day,” he said, quoting Andy Grove’s “Only the Paranoid Survive.”

Van Beurden also said he uses AI tools in his own work, including summarization tools for email and performance reviews. He views them as a way to streamline tasks while maintaining judgment and personalization.

According to Van Beurden, customer needs are similar at the entry point—checking, savings, sending and receiving money, and unsecured credit. Most customers use digital channels and visit branches for support when needed. As businesses grow, specialized financing and dedicated bankers serve firms with between $10 million and $25 million in revenue.

By combining the consumer divisions, Wells Fargo said it can unify product design and digital experiences across segments while maintaining specialized support for larger clients.

Operational Discipline and Workforce Readiness

Rolling out new technology across a large organization requires consistent training. Van Beurden described the process candidly, noting that while engineers adopt new tools quickly, most employees need training and reinforcement. “If you choose not to engage, at some point you may not be employable,” he said. “That is not a threat. It is reality. We offer the tools and the learning. It is a two-way street.”

He also highlighted Wells Fargo’s neurodiversity hiring initiative, which he launched when he led technology. The program now spans nine functions and has a retention rate of about 90 percent after four and a half years, with 15 percent of participants promoted. The bank partners with the University of Connecticut to help other companies adopt similar programs.

“We hire for careers not roles,” he said.

Throughout his discussion of leadership, operations, and AI, Van Beurden emphasized consistency and discipline. “Technology is foundational to everything we do,” he said. He reiterated the importance of simplifying the customer front door while strengthening the operational foundation behind it.