If you thought October was just about costumes and candy, think again. For the SaaS industry, Halloween arrived early—and the monster at the door is none other than OpenAI.

With the launch of its own AI-powered sales, support, and contract tools, OpenAI didn’t just step into the SaaS arena. It kicked the door off its hinges. The lineup is chilling:

- Inbound Sales Assistant: answering questions from prospects in real time and routing leads.

- GTM Assistant: a Slack companion that prepares sales calls, pulls customer histories, and answers product queries instantly.

- DocuGPT: parsing contracts into structured, searchable data, flagging unusual terms for finance teams.

- Research & Support Agents: automating support tickets and service quality improvements.

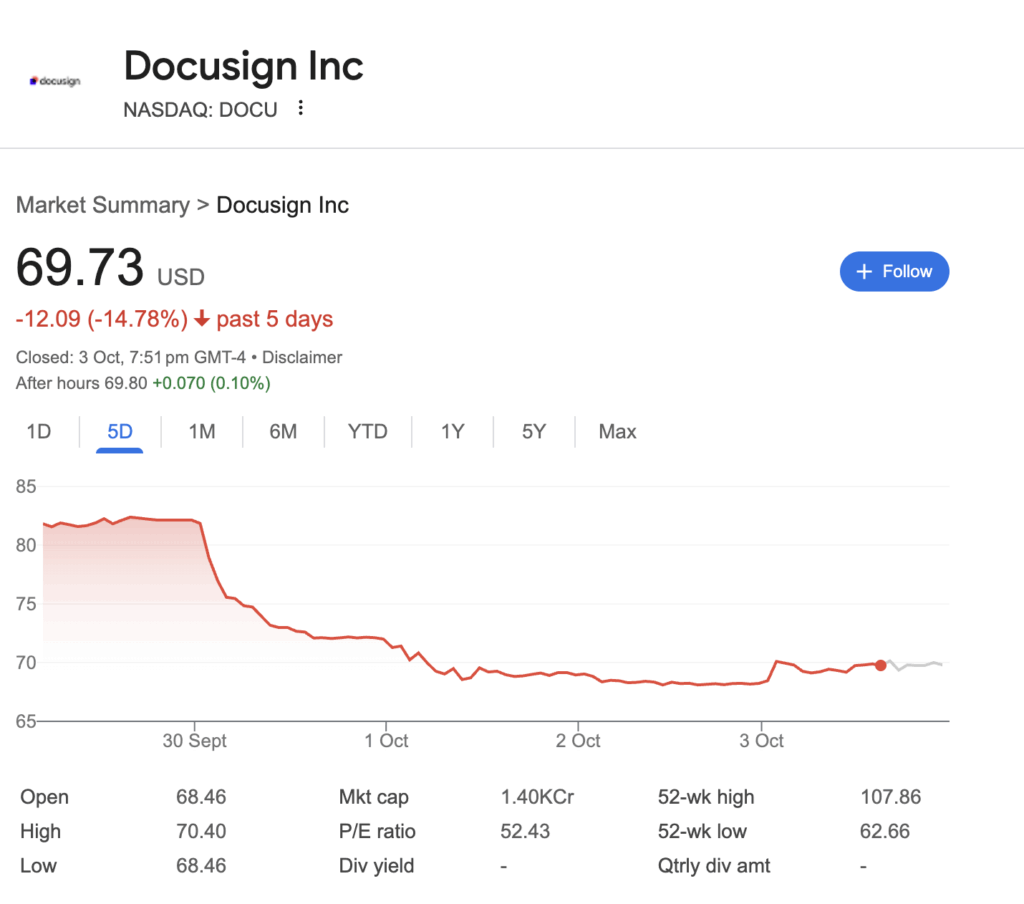

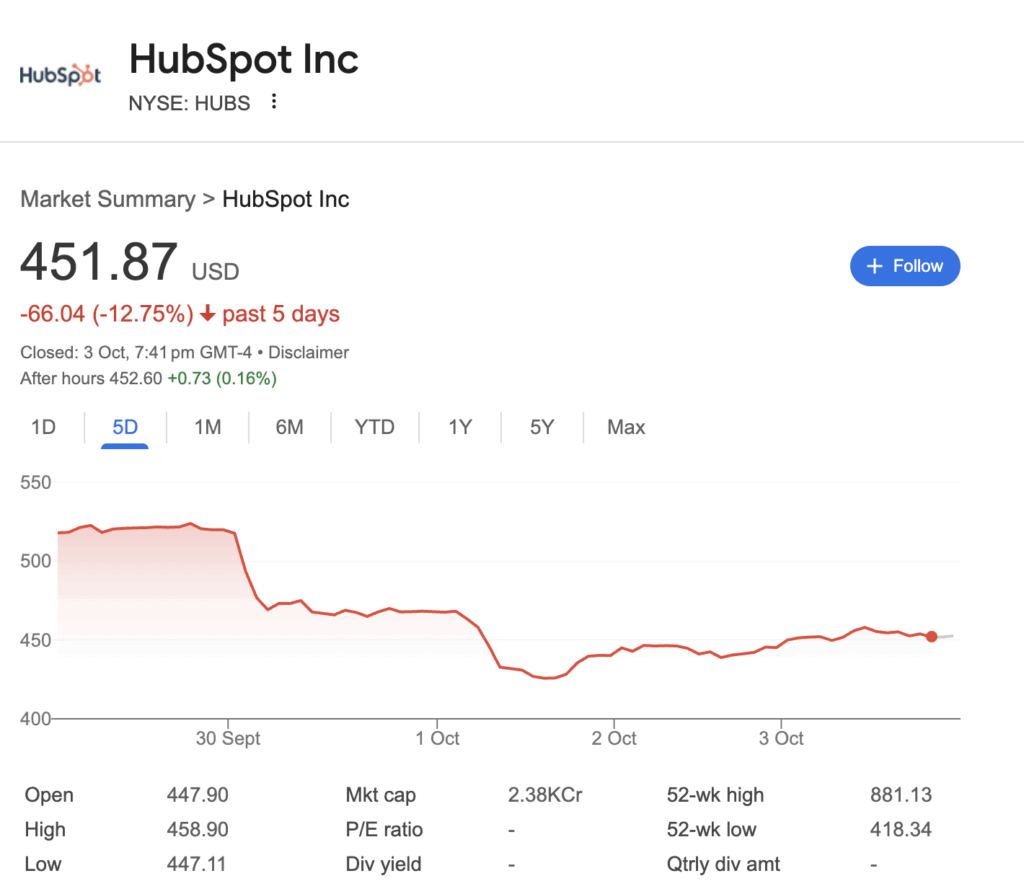

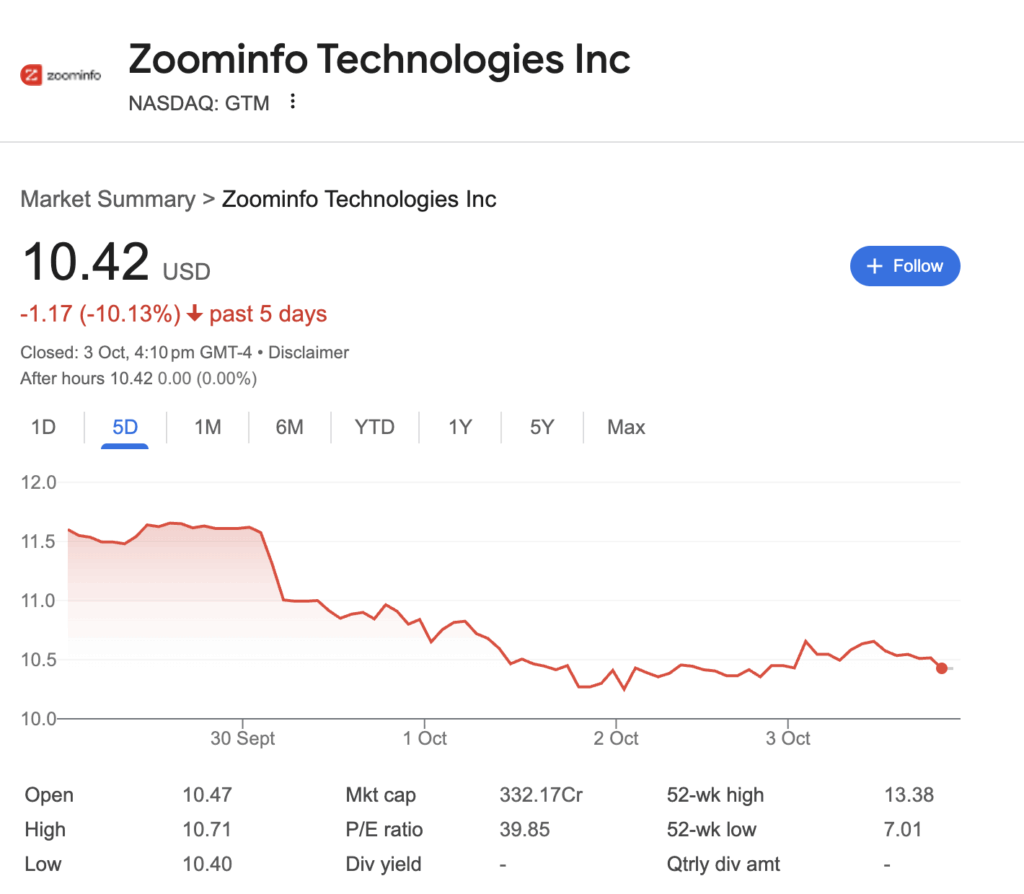

In one stroke, OpenAI has encroached on the territory of HubSpot, Salesforce, DocuSign, and ZoomInfo—four of the biggest SaaS incumbents. And Wall Street already smelled the blood. Their share prices slumped almost immediately.

SaaS Giants in the Crosshairs

Let’s not sugarcoat this: if OpenAI executes well, the business models of half the SaaS market look dangerously outdated.

- DocuSign has lived off being the de facto standard for e-signatures. But a large-language-model-driven tool that can not only sign documents but also read them, structure them, and flag legal risk makes a mere signature button look prehistoric.

- HubSpot—the darling of SMB sales—suddenly looks like a glorified email machine when AI can draft, send, personalize, and track interactions without human intervention.

- ZoomInfo has built its moat around datasets of buyer intent and contact information. AI-driven web scraping, pattern detection, and autonomous outreach tools could obliterate the value of a static database.

- Salesforce is stickier—thanks to decades of integrations—but its customers have complained for years about bloated costs and Byzantine workflows. If OpenAI prices access per usage rather than per seat, Salesforce’s margin machine faces an existential threat.

The irony? All these companies have been talking up their “AI strategies” for years. But when the AI lab itself decides to go vertical, it exposes just how thin the innovation has been.

The Pricing Time Bomb

The most controversial piece isn’t even the product—it’s the potential pricing model.

If OpenAI goes per seat, it’s a standard SaaS play. But if they go per usage, the ground shakes. Enterprises have always chafed at paying for licenses that cover hundreds of employees who barely log in. Usage-based billing tied to LLM compute could flip the entire SaaS revenue model upside down.

That’s the real Halloween horror story: recurring revenue predictability evaporates.

The One-Stop-Shop Problem

On paper, OpenAI’s vision is irresistible. Why juggle ten SaaS vendors when you can have one AI-first platform covering sales, support, contracts, and research?

But there’s a darker side: data centralization.

Imagine one company knowing:

- Who your prospects are.

- Which customers you’re servicing.

- What contracts you’re signing.

- What problems your clients are complaining about.

That’s total oversight of your business by a single external entity. Forget vendor lock-in; this is vendor omniscience.

And in Europe, GDPR regulators will have a field day. Data portability, customer consent, cross-border storage—the questions multiply. Will OpenAI run private instances? Will they allow data segregation? Or will enterprises find themselves feeding the same model that powers their competitors?

The Overhype Counter-Argument

Of course, critics will argue this is just more hype. They’re not entirely wrong.

- Enterprises don’t rip and replace core SaaS overnight. Salesforce, HubSpot, and DocuSign have entrenched integrations and switching costs.

- AI still struggles with reliability. Do you trust a bot to negotiate indemnity clauses in a million-dollar contract?

- Sales is as much about relationships as workflows. A chatbot can’t take a client to lunch.

But dismissing OpenAI outright would be naïve. Remember, AWS was “just a side business” once.

The Strategic Risk for SaaS

Here’s the uncomfortable truth: the moat of most SaaS companies is thinner than they think.

For two decades, SaaS has thrived on three pillars:

- Workflow digitization.

- Subscription pricing.

- Vendor sprawl (every business unit buys its own stack).

AI nukes all three.

- Digitization is no longer defensible—AI can replicate workflows on demand.

- Subscription pricing becomes questionable under usage-based compute models.

- Vendor sprawl collapses when an AI platform can orchestrate across functions.

If SaaS is just “structured workflows wrapped in a UI,” then LLMs threaten to commoditize the entire industry.

The Monopolization Nightmare

A more controversial angle: Do we want OpenAI to become the Microsoft of AI-era SaaS?

History teaches us that once a platform gets deep enough into enterprise stacks, it becomes nearly impossible to dislodge. Enterprises that surrender sales, support, contracts, and research to OpenAI risk creating a single point of failure. If OpenAI falters—whether due to regulation, geopolitics, or outages—millions of businesses could be stranded.

And let’s not ignore the elephant in the room: training data. If OpenAI fine-tunes on anonymized client workflows, every customer is effectively enriching the same central brain. At what point does your proprietary process become just another dataset for your competitor’s advantage?

What Should SaaS Vendors Do?

If you’re a SaaS exec reading this, Halloween is your wake-up call. The defensive playbook is limited, but it exists:

- Go Agentic, Not Cosmetic: Slapping a “GenAI” button on your dashboard won’t cut it. Build end-to-end agents that execute workflows autonomously.

- Double Down on Data Ownership: Your differentiator is not features, it’s trust. Prove to customers that their data is safe, segregated, and portable.

- Price Creatively: If OpenAI goes usage-based, you can’t stay static. Hybrid pricing models (seat + usage) may be the only survival path.

- Partner or Perish: Co-opetition with AI labs may be the only way forward. Build integrations before your clients bypass you entirely.

Conclusion: The SaaS Reckoning

For years, SaaS companies have operated like they were invincible. But the OpenAI announcement is the first credible sign that the walls are cracking.

Will HubSpot, Salesforce, DocuSign, and ZoomInfo survive? Probably. But not without pain. Their valuations are built on the assumption of perpetual growth, sticky customers, and high switching costs. AI calls all three into question.

The bigger, more unsettling question is this: do we really want a world where one AI vendor runs the entire go-to-market stack of global enterprises?

Because if we sleepwalk into it, the SaaS “ecosystem” we’ve spent two decades building might soon look like a haunted house—full of ghosts of companies that once thought they were untouchable.

Happy Halloween, SaaS.