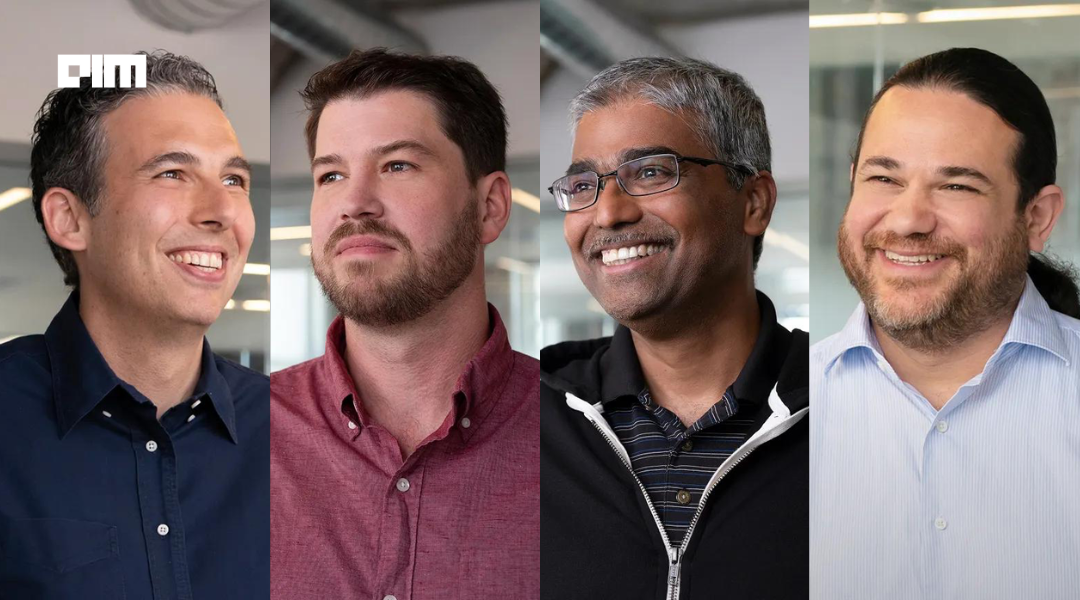

Before launching Bedrock Robotics, CEO Boris Sofman spent years working on autonomous trucking at Waymo and helped lead the first fully driverless vehicles onto public roads. Now, alongside fellow Waymo veterans Kevin Peterson and Ajay Gummalla, and former Segment engineering leader Tom Eliaz, he’s building a system that brings advanced autonomy to construction equipment: starting with excavators.

“Construction is one of the largest industries in our country, it affects the cost of pretty much everything,” Sofman said in an interview. “There’s so many things that are broken with infrastructure and with our buildings. There’s so many things that cost so much more than they should.”

Bedrock Robotics emerged from stealth this week with $80 million in funding led by Eclipse and 8VC. The company retrofits standard construction vehicles with cameras, lidar, compute, and software that enable the machines to operate autonomously. Rather than replacing fleets, Bedrock is designed to work with what contractors already have. “We’re not competing with Caterpillar and trying to make machines. We’re trying to make machines more intelligent,” Sofman said in a statement to Forbes.

Applying ML to Dirt

Sofman draws a direct line between his work at Waymo and the challenges of construction automation. “Excavators, bulldozers, and loaders must understand site terrain, adapt to changing conditions, and execute intricate maneuvers with tons of steel,” he wrote in a company blog post. “The difference is these machines don’t just navigate the world, they sculpt it with centimeter-level precision.”

The company’s first product, the Bedrock Operator, can be installed in less than four hours and enables machines to work around the clock without human intervention. “Now you’re able to actually… take that input and give it… a real intention,” Sofman said in an interview, describing how the system converts a defined goal, such as shaping a trench, into an executable plan through learned behavior. “The model is actually interpreting all of this and extrapolating out to a trajectory of what it should do.”

According to Sofman, Bedrock’s core learning model is built similarly to a LLM. “You have like big model that effectively is learning and then outputting this trajectory- it’s a little bit like an LLM but instead of words you’re actually modeling it based on real world things.”

That means modeling real-world resistance from soil, rocks, and buried infrastructure: factors human operators learn over years of experience. “There’s actually some pretty bad things that can happen,” he said. “You could destroy the pipe, cut fiber to DFW… that’s like a million dollars every few minutes.”

But it’s precisely this repeatable, labor-intensive work where Bedrock sees opportunity. “There’s something like $120 billion of excavation contracts per year in the U.S.,” Sofman said. “And excavators… are often times like 25–30% of fleets.”

Scaling Under Constraints

Bedrock’s system is already deployed at active job sites in Texas, Arizona, Arkansas, and California with partners including Sundt Construction, Zachry Construction, Champion Site Prep, and Capitol Aggregates. “From our earliest conversations with Bedrock, it was clear they had a strong grasp on the challenges we were trying to solve with robotics,” said Eric Cylwik, director of innovation at Sundt. “When a technology proves its value in the field, this industry will pick it up fast.”

Sofman doesn’t believe autonomy will eliminate jobs, but instead will expand capacity. “This is not a zero-sum game,” he said. “There’s an astronomical demand for projects… and it’s actually getting a lot worse.”

Contractors, he said, are already turning down funded projects due to labor shortages. “We’ve heard of literally multi-billion dollar projects that got approved and funded but don’t get off the ground because they don’t pencil out… meaning you just cannot do them profitably.”

Sofman believes the ability to finish work faster and with more predictable costs will ripple through the entire project lifecycle. “So now the developer that funded that project and has to pay 9% interest on a $400 million loan has a completely different unit economics on the project so they’ll invest in more projects.”

The company plans to begin commercial deployments with no human operator on board in 2026.

“This is the number one problem that we’re hearing in the industry from almost everybody we talk to,” Sofman said. “And every single GC we’ve talked to has more jobs that they could take on that they just like physically can’t.”